Last year, France stepped up its engagements with Africa, and for Nigeria this included a meeting of some of the country’s top business leaders with President Emmanuel Macron, who also inaugurated the France-Nigeria business council, an initiative to enhance business relations.

As France deepened trade and investments in Nigeria, its largest partner on the African continent, it also sought to have more Nigerian businesses establish presence either in France or with French businesses.

Following the series of high-level engagements between France and Nigeria in recent years, and especially last year, “there have been several contracts and partnership agreements that have been signed,” said Emmanuelle Blatmann, ambassador of France to Nigeria in an exclusive interview with BusinessDay. An example she gave is Eutelsat and Globacom that signed a contract, and also, ongoing negotiations for the banking sector, but which she could not provide details as they haven’t been finalised.

Any company that wants to thrive and prosper, here in Nigeria or in any other country, needs to be able to count on a reliable, stable tax and legal environment; a justice system that is efficient and as independent as possible

“I think this year we will see several Nigerian banks moving into France. That’s great news. I think they are seizing the opportunity presented after Brexit, where we have made it clear that Paris can become the hub for finance in Europe (after London),” she enthused.

As France’s major trade partner in Africa, Nigeria has in the last ten years seen both Foreign Direct Investments (FDI) and trade with France growing. Even though Nigeria is surrounded by francophone countries in West Africa, Blatmann says “60 percent of the total net foreign direct investment from France to Western Africa, which is majority French-speaking, has been to Nigeria.”

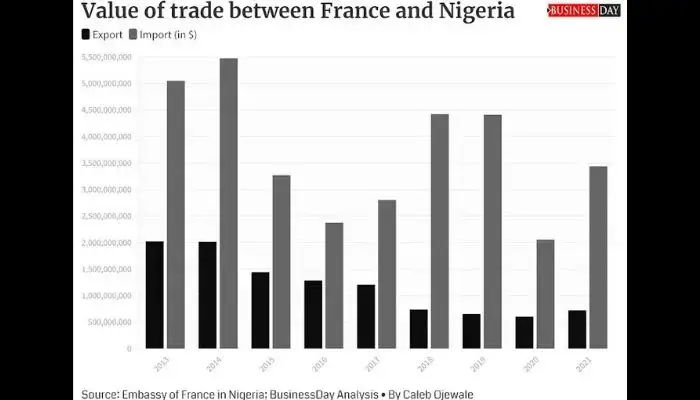

In trade, generally, France’s imports from Nigeria were highest in 2014 when it was $5.4 billion before declining in 2015 to $3.2 billion. In 2017, it started picking up again, averaging $4.4 billion between 2018 and 2019 before dropping to $2.05 billion in 2020, the pandemic year. Last year, it rebounded to $3.4 billion, higher than every of the lowest years in the last nine years. The French exports to Nigeria, have however, been declining even as imports from Nigeria increase.

French investments in Nigeria

On the investment angle, French investment stock in Nigeria is currently about 70 percent more than it was in 2010, and even almost doubled at some point between 2017 and 2018. French companies, estimated around 100 in Nigeria and employing close to 10,000 Nigerian employees, have been participating in the economic growth of the country, training people, and building skills.

“Nigeria is not only a major trade partner but also the major country where (French) investments have been made over the last 10 years. One might think that France mostly invests in French speaking countries, but that actually is not true. The statistics are really impressive,” she says.

Over the decades and “Unlike others,” according to the ambassador, French businesses tend to favour local investments (that produce locally) over just exporting finished goods to Nigeria, which is one specificity she emphasises is important to note. This, she says is also responsible for French businesses holding direct investment stock of around 10 billion euros, which is 100 percent increase over the last 10 years. This makes France one of the major investors in Nigeria, she says.

The French companies are present from Total Energies in Oil and gas, to transportation (AirFrance, Bollore, which was managing Tin Can port), in pharmaceutical industry with Biogaran, ENGIE Energy Access in renewable energy, and others in professional services, finance, and in the security sector. In Agriculture and food processing there is Fan Milk, which is a subsidiary of the Danone company, and also Nutriset, which recently completed a multimillion dollar facility in Kano for the production of nutritional bars. There is also Peugeot that has an assembly plant in Kaduna that will commissioned soon.

“These are not just random investments, but always with a purpose of working with Nigerian local partners with a view to development,” says Blatmann.

More areas of opportunity

Yet, there are even more areas the French would be willing to do business in Nigeria. Blatmann notes that several contracts have been signed between the Nigerian and French private sector in agriculture (and food processing), describing it as a sector in which there’s a lot of interest, and a lot of potential for development in the coming years.

Another sector the French is looking to develop and where it sees a lot of interest is defence and security. In early April (this year), there was a business seminar in Abuja, where 17 top French security companies came to showcase their products; equipment, vehicles, drones. It was an opportunity to offer solutions to some of the security issues in Nigeria, and also to reply to some of the requests from Nigerian authorities.

The event, BusinessDay learnt recorded more than double the attendance expected, and at the end an MOU was signed for a drone Academy, with hundreds of contacts exchanged for the three days that it lasted.

“What is interesting is they are not just trying to sell their products by exporting here. The idea is also to have partnership packages that include training and having maintenance here in Nigeria,” says Blatmann. “If you sell something and nobody can maintain it, after few years, nobody can use it anymore. So the idea is to train local talents, so they can do it themselves. This is also in a perspective of development.”

In the larger picture, it is also in the idea that on a regional scale, Nigeria can become a hub for maintenance of helicopters, planes and military equipment, following successful partnerships with French companies. This, the French Ambassador says, “would be good, because it is also part of diversifying the economy here and creating jobs”.

Limitations to doing business in Nigeria

When Nigeria is being promoted as an investment destination, it still does not have a good image for companies who have never been here, or never set foot in Nigeria or are not familiar with Africa. The continent (generally) doesn’t have a good image, Blatmann explains.

She says it is important to change the narrative and perception that French private sector and French public opinion has of Nigeria, “because there’s so much more than Boko Haram, insecurity, war or whatever else.”

At the same time, insecurity is a reality in Nigeria and it is an obstacle because some people fear that they cannot send expats, especially to some areas in Nigeria.

Another issue is the business environment. “Any company that wants to thrive and prosper, here in Nigeria or in any other country, needs to be able to count on a reliable, stable tax and legal environment; a justice system that is efficient and as independent as possible. So of course, it is very important that the authorities promote a safe environment for foreign investors,” says Blatmann.

A key issue in the business environment is access to foreign exchange. Anybody who wants to conduct and grow a business as a foreign investor needs to make transactions, get his/her money back and also the profits it generates. Therefore, if there were an easier way to access foreign currency for foreign investors, this would lead to very significant increase in foreign investments in Nigeria, she explains.

“We can understand why there are some restrictions to protect the local currency, but at the same time, you also need foreign investors. Every country does, even France, and that’s why we’re looking forward to any Nigerian investors,” she says.

Supporting Nigeria’s food security

Apart from humanitarian assistance to provide food to thousands of Nigerians through several NGOs, the French as BusinessDay learnt, also has ongoing irrigation projects in different states to support farming. There are also ongoing discussions with French research and technical institutions to work on the modernization and rehabilitation of value chains, especially fisheries, meat, dairy in Nigeria.

One of such is an agreement on wholesale food markets in Lagos, to have partnerships on modernization of the food markets (and later across the country). This will be funded by the French Agency for Development, which has already built or rehabilitated about 2000 kilometres of rural roads in Nigeria over the years, in order to link farmers to markets. Without access to the markets, farmers cannot sell.

Blatmann is particularly thrilled by Nutriset, which recently established a factory in Kano. The French company produces high quality nutritional products, especially Nutritional Bars made out of peanuts, and mostly used to feed malnourished children or women.

The company’s main clients are United Nations agencies and before, they would import the raw materials from Africa, process in France then sell to the United Nations, who would then re-import to Africa for distribution.

By investing locally, in the peanuts supply chain alone, the company is expected to procure between 5000 and 7000 tonnes of peanuts in Nigeria for processing and work with an estimated 8000 small holder farmers. So far, it has created 120 direct jobs in the factory and believes production from the facility will benefit 750,000 children just in one year. “I think it is quite amazing and is part of the solutions needed to fight food insecurity,” she says. “This is typically what I would like to see more often all over the place because the benefits are huge.”

The full interview with Emmanuelle Blatmann, ambassador of France to Nigeria, which is also her first major interview since resuming in the country, will be published by BusinessDay next week.